توضیحات

Bankrolling you today. Preparing you for tomorrow.

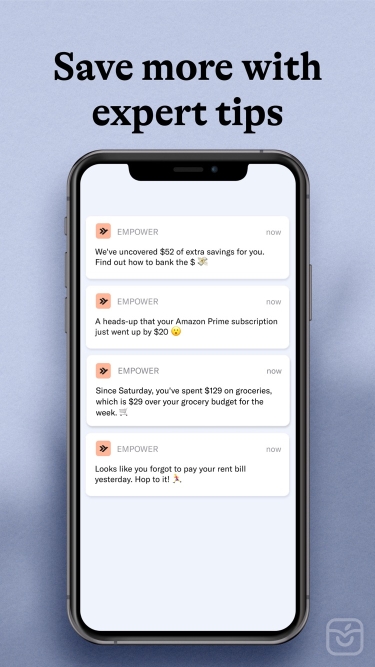

No matter what lies ahead, we’ll help you thrive. Empower is mobile banking designed for today’s generation. Get cash advance up to $250*. Spend mindfully with no overdraft fees. Build your savings for the future. Because this is what banking should be, a partner that understands you and gets you where you want to go.

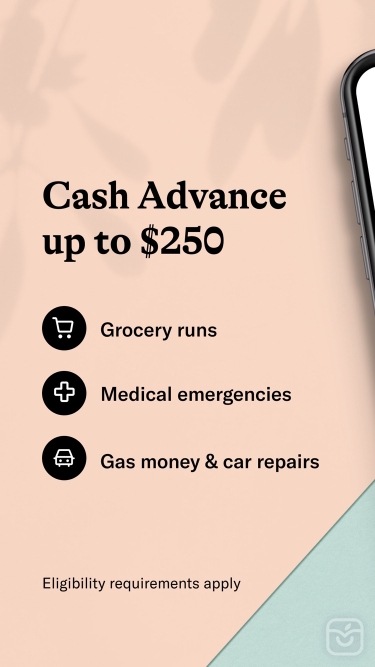

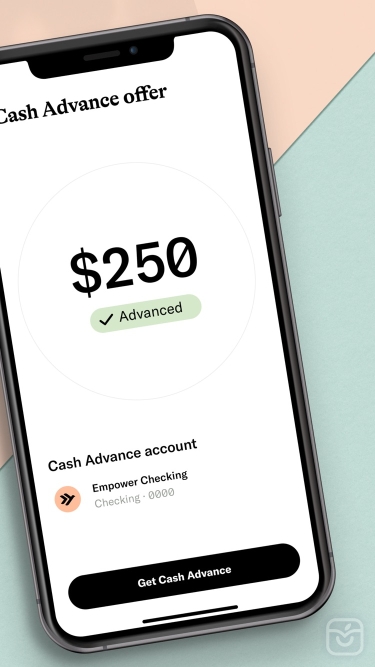

Empower Cash Advance*: We know you’re doing everything you can to get ahead, but some months it’s just not enough. Empower will float you up to $250 in fast cash when you need it most. There’s no interest, no late fees, and no credit checks. Just pay us back when you get your next paycheck.

Empower Interest Checking**: We know it’s tough to find a checking account without the sneaky fees and with the flexibility you need. Empower offers instant delivery of your cash advance for life’s little emergencies. There’s no account minimums and no overdraft or insufficient funds fees, plus count on 3 ATM reimbursements every single month^. Your account also comes with an Empower Visa debit card and built-in, easy-to-use, real-time spend tracking to keep your expenses under control. And on top of all that, Empower will pay you 0.20% APY** on all your deposits so you’re earning money daily.

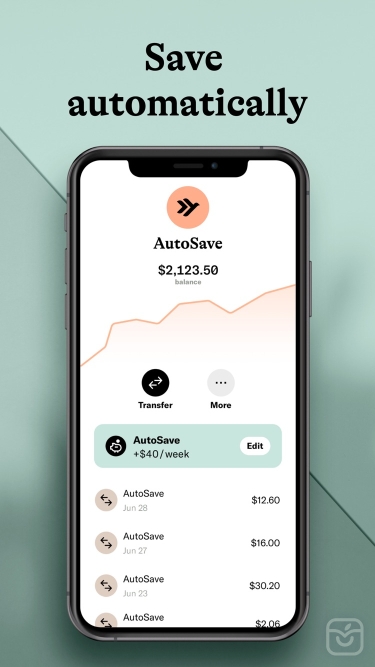

Empower Automated Saving**: We know how hard saving can be, and the trick is to save small amounts continuously — and let an app do it for you. Empower automates the process of saving so you never have to lift a finger. Just set a weekly savings target, and we’ll monitor your income and spending to identify the best time to set money aside from your checking account into savings (where you’re less likely to spend it!). It’s called AutoSave — just set it and forget it. And if you open an Empower Interest Checking account, Empower will pay you 0.20% APY** on all your savings.

Empower deposits are FDIC insured up to $250,000**.

Privacy: Your personal data belongs to you, and you alone. We would never share or sell your information to another party.

Security: We keep your money safe and sound with the latest-and-greatest bank-grade security features and protections: AES 256-bit encryption, multi-factor authentication, Touch/Face ID.

For more information, visit empower.me.

- Eligibility requirements apply. Minimum direct deposits to an Empower Checking Account, among other conditions, are necessary to qualify for advances greater than $50. Free instant delivery is available for eligible Empower Checking Account customers.

^ Reimbursement for up to 3 ATM fees per month, with a maximum reimbursement of $10 per ATM withdrawal.

** Banking services provided by nbkc bank, Member FDIC. 0.20% Annual Percentage Yield (APY) may change at any time. APY as of Jan 20, 2021. Empower charges an auto-recurring monthly subscription fee of $8 for access to the full suite of money management features offered on the platform. The subscription fee will apply (a) after the 14-day free trial concludes for first-time customers, and (b) immediately for customers returning for a second or subsequent subscription.

Empower does not charge foreign transaction fees for the use of the Empower Visa Debit Card outside of the US. However, Visa charges a foreign transaction fee of 1%. Empower does not reimburse this 1% transaction fee on foreign ATM transactions or on any other foreign transactions or purchases.

تغییرات نسخه اخیر

توسعه دهنده

Empower Finance